There are mistakes, making a bad decision or taking a wrong turn, which have fleeting consequences that can be fixed by quickly course-correcting to get back on track. And there are MISTAKES, trying to proving someone wrong about a character assessment they have made about you, which can turn into life lessons. This real estate investing experience was the all capitals version of MISTAKE.

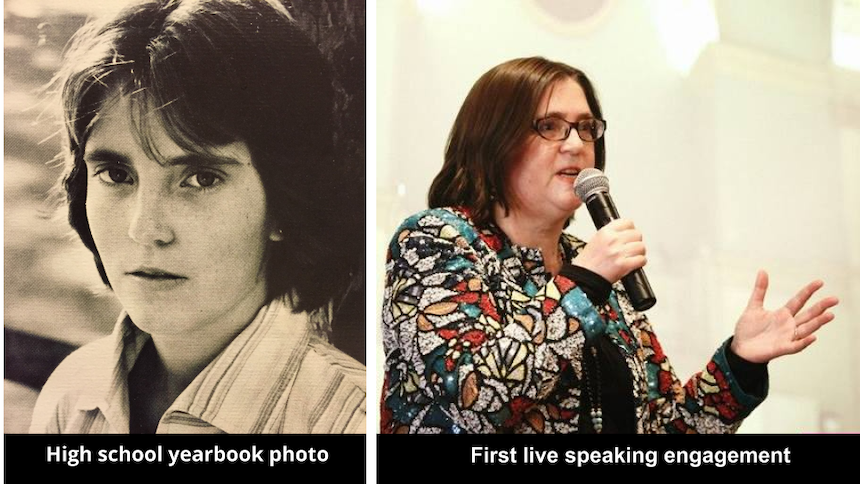

In my family, I was the only girl, the oldest, with four brothers. I wasn’t sure what I wanted to be when I grew up. I tried to figure it out, including taking classes on seemingly random stuff, self-improvement programs like the est training, a precursor to Landmark Education today, and volunteering. Especially in my family, people began to think of me as “irresponsible” and told me to “be sensible” and “stop daydreaming.” And I started to stubbornly resist that characterization in passive-aggressive ways.

One of the measures of being “responsible” I internalized was being able to make good money or marry a man who did. As an stubborn, independent and entrepreneurial woman, I decided to become a real estate investor and “show them.” Real estate investing by 2006 was being touted as one of the best ways to make fast money. Lots of real estate investing groups sprung up and I joined one. We took buses to Baltimore, Syracuse and Philadelphia and saw dozens of houses. We tramped through gutted houses in rough neighborhoods, learning from property inspectors about what to look for, what made a good investment or a bad one. We met sellers and property managers and learned about how to put property into land trusts to avoid personal liability. I thought I was ready.

In bullish “I’ll show you” mode, I decided to buy two 2-family houses in Syracuse and set out to get a mortgage. I had no credit cards, car or home mortgage so the broker had a terrible time finding anyone willing to give me two mortgages, even with terrible interest rates. I paid full price and did not even try to negotiate. I ignored all the signs, thinking that backing down would mean I was a “failure” again. I never walked the neighborhood to see if I felt safe there. The properties were cheap and, in 2006, I bought them, plus a single family house in North Philly later. I wanted to make money AND provide nice homes at reasonable rents. That turned out to be an unrealistic fantasy. I rented a car and went up with my husband to stage the vacant house before we started finding renters. That weekend and my ongoing collaboration with eight other female real estate investors, were the best experiences of my troubled real estate investing career.

After that, everything went wrong. The property manager I paid took the money and skipped the work so the code violations piled up. I wasn’t the only one he robbed. I never bothered to put the property in land trusts so I was personally liable. I didn’t get insurance to cover the first year and the hot water heater blew in the winter, a huge expense to replace. Several of the renters trashed the apartments and they had to repair holes and repaint over and over again. I was far away, without a car, not monitoring my own properties. And the housing market crashed in 2007 so the value of both properties halved in a year. Ultimately, I lost both properties to foreclosure and paid the city thousands in code violations. On the second property, it sold in 2015 but did not close for over two years. In that time, there was a fire and, since I was still the named owner, I was still on the hook for the code violations but the new owners would not allow my property managers to do the work. I finally got rid of it in 2017, the year after David died, when I was still barely functional and in serious financial straits. The Philly property I sold at a loss in 2009. The legal document stated that all the fixtures had to stay intact but someone stole the hot water heater that night, once we both signed and they had cashed the bank check. I kept hanging in there with my real estate investment properties because I was going to “show them.”

In the end, I found out that there is a big difference between trying to prove someone wrong and trusting myself. When I embarked on real estate investing, I was intent on proving I was “not irresponsible,” changing the entrenched ideas people had about who I was, rather than deciding what “responsible” meant to me and using that to direct my path. Needless to say, this fiasco did not help change public opinion of me.

What did I learn?

- If all the clues indicate a course of action is a bad idea, listen. Look closely at the data, the environment and check in with your intuitive knowing about what to do next. Above all, trust yourself mind, body and spirit first. You will be the one to live with the consequences for the actions you take.

- People’s opinions, especially family characterizations, become fully baked, starting in childhood. They are more likely to see those actions which support the initial assessment rather than any change. Entropy rules. Acting from “not __________” is guaranteed to cloud judgement and lead to missteps.

- Shame is common after making a financial MISTAKE, like the one I made. People in financial difficulties are shamed all the time for losing a house or job, or for needing help with health expenses. Until I faced my shame and grief about my real estate investing experiences, all my financial decisions were shaped by this really bad one, trying to “prove another person wrong” about me. In this time of global economic uproar, it’s important to build our innate resilience because everything we typically rely on to know who we are, like our health, our jobs, our homes, our connection to others and common values like kindness, are in flux.

I had to 1) Re-engage: start trusting myself to be responsible with money again (increase income, decrease expenses, choose to thrive instead of just survive); 2) Reinvent my identity: make my decisions and actions congruent with who I truly am, and 3) Rebuild my networks to include people who see me right now, shaped by my past, but no longer ruled by it.

I’m excited to be offering (W)Righting Your Way Through Transition: a 6-week journey to get back on track for my clients, using these strategies to solve real-life challenges about health, money, time, relationships, time and business/career. Go to my website, BadWidow.com, to learn more.

CHALLENGE:

I challenge you to find a mistake you made which you have not yet forgiven yourself for. Look for pockets of shame. That’s where you will find the opportunity for seismic shifts. Look at the experience newly for what happened, what drove the decision and what feelings got layered on afterwards. As you read, mine was a doozy. Then let it go as past history, make amends, if necessary, and begin to heal.