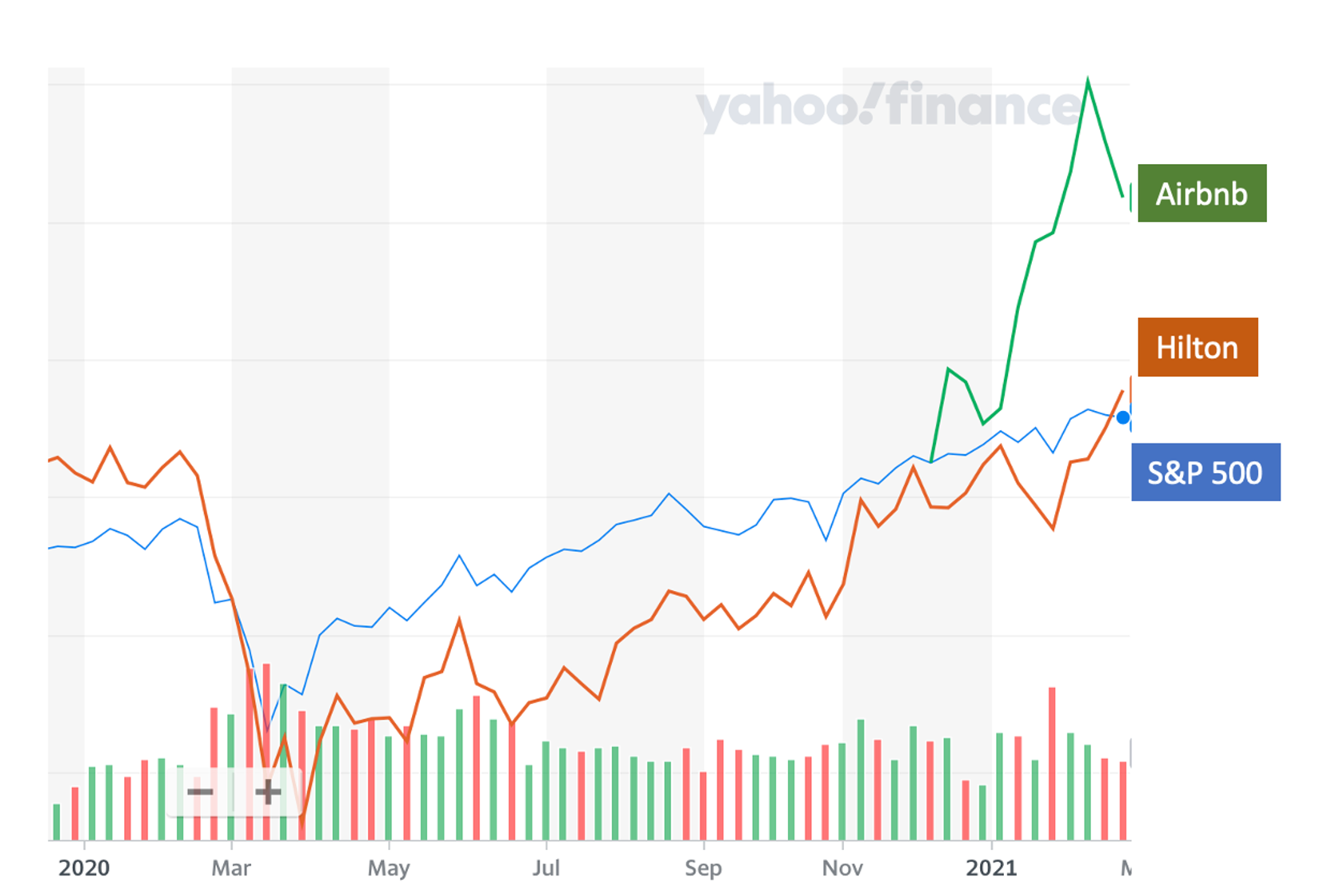

Don’t be fooled by the recovery of hotel stocks in a resurgent stock market. Unless hotel brands redefine their purpose and business model, the full-service hotel industry is facing near evisceration, resulting in the loss of millions of jobs, unattractive cities with stranded developments and billions of dollars in tax revenue lost for governments. Airbnb is valued at over $100 billion – more than all the major hotel brands combined at their peak values and has done “a Tesla” to the hotel industry by redefining the category with new technologies that leapfrog hoteliers in customer service. For high-end hotels, a comeback will require a market-based resolution of the talent crisis, led by the consolidation of management firms and brands alongside expansion into alternative accommodations.

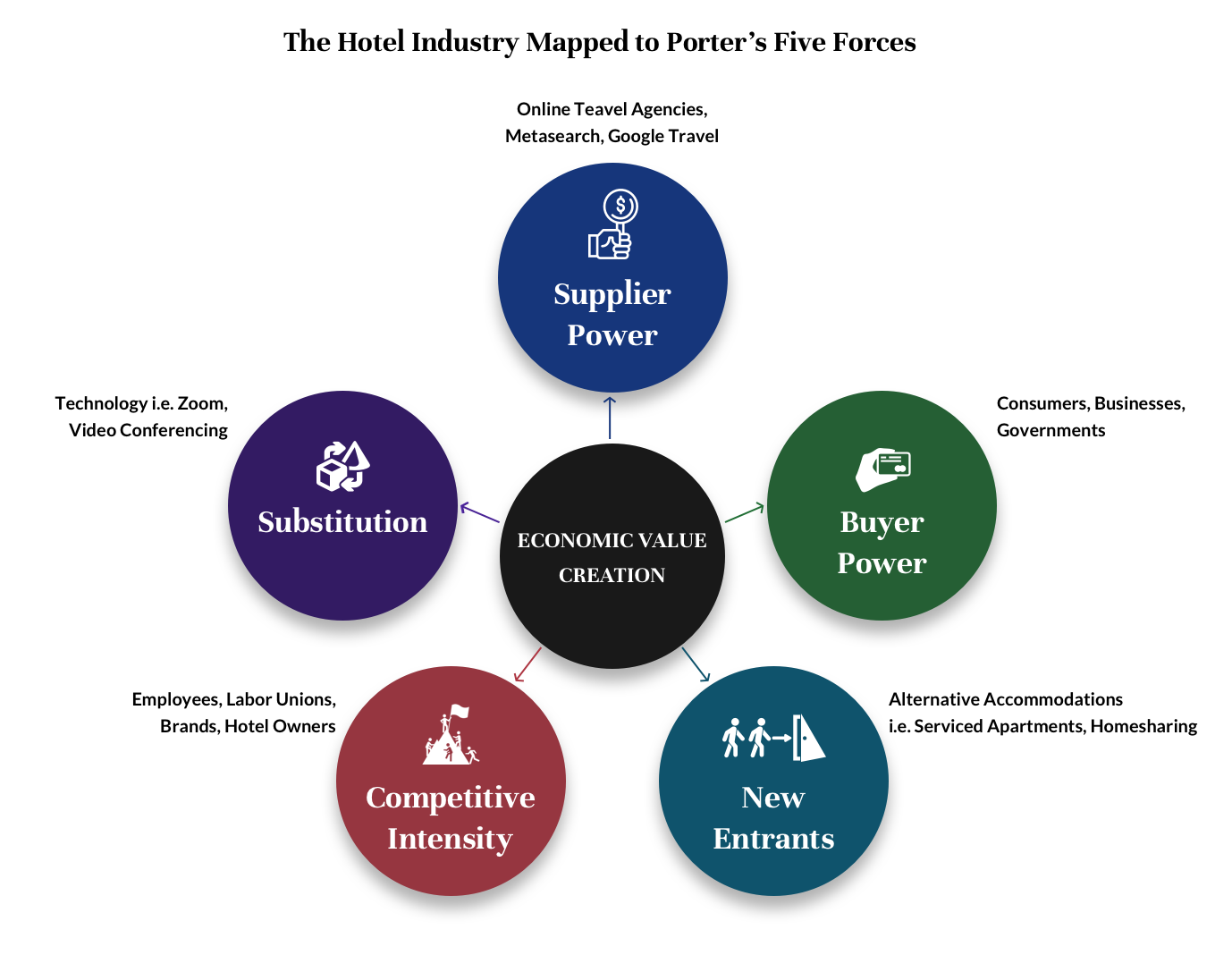

What makes the U.S. hotel industry dysfunctional is the fragmentation of decision rights and power. Brands divested real estate and management in favor of a franchising model, handing power to additional stakeholders with conflicts of interest. If leadership is defined by controlling either real estate or owning the customer or employee, then the industry is highly decentralized and there is no leader.

Because OTAs and third-party sites continue to make up a significant portion of bookings, hotels continue to be subject to their commissions and fees to sell rooms.

Consumers and governments have the power to drive change in the industry’s existing practices.

The industry is also facing new competitors with the rise of Airbnb and alternative accommodations, threatening the position of the existing brands and management companies. Internally, the industry is struggling with high rivalry due to the oversupply of new and indistinguishable brands. Covid-19 also brought on the rise of technology that allowed people to hold meetings and conferences virtually – consequentially, a threat to group business and large convention hotels.

The effect of the Covid-19 pandemic will linger for years and governments are unlikely to lead or bail out small businesses, family offices, or institutional real estate companies. In markets like China, the hotel industry will likely recover with the old factory.

However, the U.S. hotel industry requires a reset and a new engine, powered by talent and consumers and built by data scientists and technologists, not traditional real estate developers and hotel brand managers.

A perfect storm is here and the race is on. What will it take to save the industry? Can the legacy brands save the day or will a new wave of start-ups backed by emboldened investors leverage the storm to accelerate their extinction?