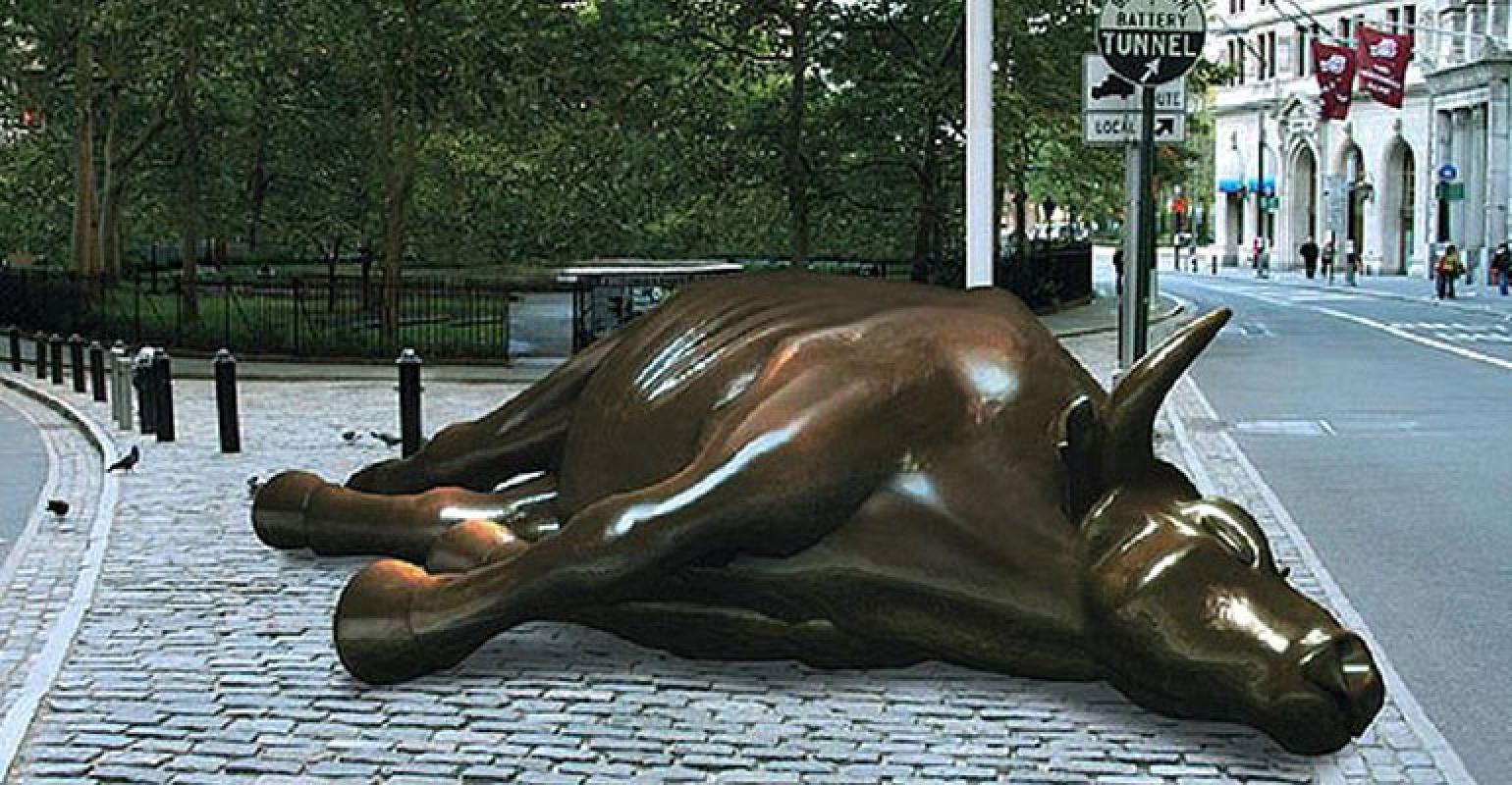

We are hovering around a 30% loss. Given the fact that we have had a 47% chance of this happening for the last 2 years, it is not surprising. The “surprise” is always the ‘WHY’. I do not think anyone saw a bat virus taking down the world economy, but here we are.

Looking past this pandemic the question is how quickly will things recover? What kind of recovery will we have? There are many questions swirling around this latest economic mushroom cloud.

Here is what I do know – History. Why do I believe we will get past this? Because we always do. 100% of the time that we have experienced “the end of the world” economically, we have recovered. I do not believe this will be the first time that we do not.

Below is the history of recovery:

Unfortunately, I have no idea the answers to the “???” above. This is definitely a different scenario as it has been a global crisis and thus the impact can be stronger and last longer. The current economic outlook is that we will see a “L” shape recovery. This makes sense to me from a historical perspective. The question on everyone’s mind including my own, is where is the bottom and that can only be answered in the weeks and months to come as we see how the Covid-19 virus responds to the drastic measures taking by our world governments.

One last thing that we need to understand is the math behind recovery. Remember that it is not down 30% up 30% and we are back to even. The math does not work like that. This chart explains the math of decline and recovery:

As I have mentioned in previous articles, if you are not interested in staying on this ride, it is ok to get off. For most investors, even at a 30% decline their values are close to January 2019 start values. If you are not sure where things are going to end up and you are concerned about long-term impact talk to your advisor about sitting on the sidelines until the future is a little clearer.