Everyone wants to achieve financial freedoms but unfortunately, very few people know how to achieve it. If achieving financial freedom is among the main your goals, but you don’t know how to achieve and what you need to do to achieve that goal? This article is for you!

First of all, you need to know what financial freedom is. The term financial freedom became famous when Robert Kiyosaki’s bestseller Rich Dad, Poor Dad, was published.

As per Richdad.com

“Financial freedom is about much more than just having money. It’s the freedom to be who you really are and do what you really want in life. It’s about following your passion, making choices that aren’t influenced by your bank account, and living life on your terms.”

“What then is freedom? The power to live as one wishes.” — Marcus Tullius Cicero

As per the Wikipedia.com

“Financial freedom can be defined as an individual’s ability to cover all their economic needs without having to carry out any type of activity. In relation to financial freedom, the term passive income is used as the source of income that does not require the activity to be received by the beneficiary. “

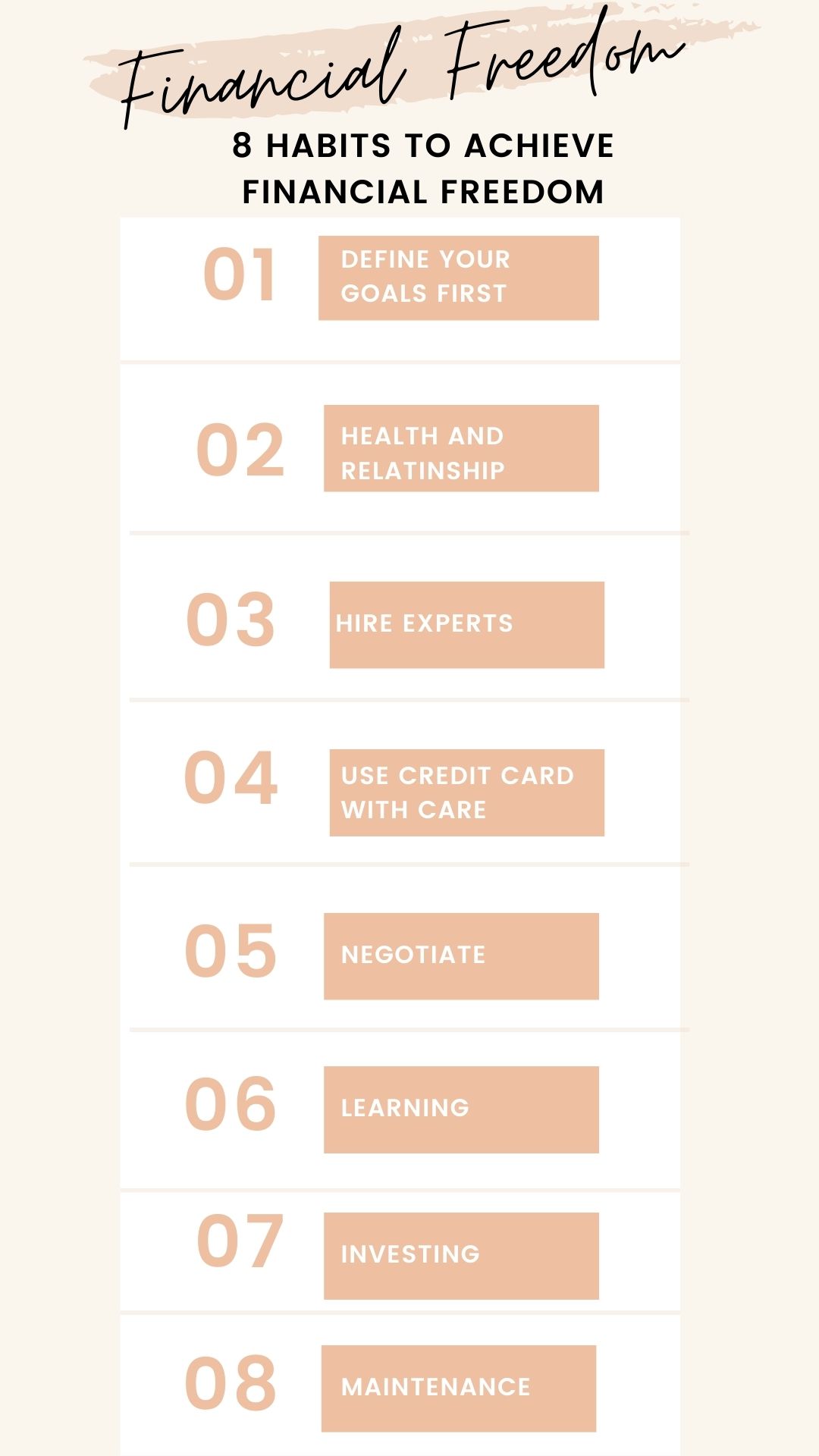

8 Habits To Achieve Financial Freedom

If you liked the idea of having the financial freedom to live life as you see fit, we will now show you practical habits for reaching that goal.

It is important to note that the 8 habits that we will present below will help you organize your finances But only if you work hard and follow those habits.

1. Define Your Goals First

Setting goals has many benefits to your mental and physical health. How do you want to live life? Do you have a “list of items” that you want to do before you die? If you want to progress, you should be able to measure.

To measure, you need to accurately define your annual goals and align them with your long-term vision for the future. It is not enough to know what you DO NOT want or what you DO NOT like. You have to define what you want to take care of in your life.

2. Take Good Care Of Your Health And Relationships

Taking care of your health and relationship is very important. To take care of your health you should exercise, eat properly and healthy, take health insurance.

if you are only in a relationship that matters around you, you may have been able to be financially free but for me, you have lost the best of life: living in a good company. Solitude kills more than anything else. Yes, more than tobacco, alcohol, cardiovascular problems or cancer. keep your self in good and healthy relationship.

3. Hire Experts

Don’t be proud of “I know everything” attitude Others know more than you. Below are the example of experts which can help you to leverage your income and by hiring them you can take better advice as well as they can help you to save a lot of money.

- If you are in a stable and very good financial state, here a tax adviser. You can earn thousands of dollars on taxes.

- If you have an online business, hire a mentor.

These services are essential to make an important leap in quality in your capital generation.

4. Use Credit Cards With Care

If you are able to pay them monthly, without paying penalties for expenses in the good money. You can work with these tools that allow you to delay payment for 30 days.

But the majority of the mortals are unable to work with these resources, without putting their feet up. In this case, it is better to reduce the number of cards to the maximum. One card per person and there is a charge. Thus, there was no credit generated month by month.

You will not achieve financial independence if you spend more than you get. Here is list of best credit card BIN checker services which you can visit and check BIN.

5. Negotiate

Most people don’t believe in negotiations for goods and services because they worry it makes them look cheap but because of this only causes them thousands of dollars each year. You can try to negotiate with small vendors or small business which tend to open for negotiation.

6. Learning

Enable the secret to grow. Learning is a continuous process, It opens your door to wealth and prosperity. Invest in any education that allows you to withdraw more money, gives happiness in the future.

7. Investing

I will start investing tomorrow is never going to happen. Start small but start today. The magic of compound interest will help it increase exponentially over time, but you need a lot of time to achieve meaningful growth.

8. Maintenance

It makes you oblivious to be cautious with your belongings. For example. you have a pair of shoes that have more than 5 years. Obviously, you will not use them daily, but when you have to go out, you don’t have to buy anything. It saves time and money.