Famous author and motivational speaker Anthony Jay Robbins once said, “Every problem is a gift without problems, we would not grow.” While 2020 had been rich in problems, Apple, staying true to this quote, managed to turn the tide and grow in adversity through its consistent efforts.

Although 2020 was about survival for many sectors, Apple managed to attain significant benchmarks before hitting a low and back to recovery. For starters, the Cupertino-based tech giant became the first US company to have a market value of $2 trillion. There’s no doubt that the achievement was a combined result of numerous small accomplishments. Here’s how 2020 was for Apple.

Apple iPhone Topping the List

According to a report, the top 10 highest selling smartphones during the first half of 2020 include;

| 1 | Apple iPhone 11 | 37.7 |

| 2 | Samsung Galaxy A51 | 11.4 |

| 3 | Xiaomi Redmi Note 8 | 11 |

| 4 | Xiaomi Redmi Note 8 Pro | – |

| 5 | Apple iPhone SE | 8.7 |

| 6 | Apple iPhone XR | 8 |

| 7 | Apple iPhone 11 Pro Max | 7.7 |

| 8 | Xiaomi Redmi 8A | 7.3 |

| 9 | Xiaomi Redmi 8 | 6.8 |

| 10 | Apple iPhone 11 Pro | 6.7 |

If we closely analyze the table above, we can see a significant gap between the highest selling smartphone, iPhone 11, and the second on the list, Galaxy A51. This is despite the large price difference between both – iPhone 11 starts from $599, whereas A51 is available for $399.

To top it all, this was during the first six months of 2020 the time of year when the world hit a pause and suffered a crisis.

If this doesn’t impress, you might want to take a look at Apple’s consolidated statement of operations. The report states that Apple touched the mark of $111 billion in 2020 by July 30 against the total revenue of $109 billion earned in 2019.

However, this is just one side of the coin. The ‘Luxury Smartphone Making Company’ did have a roller coaster ride. Let’s have a look at all the aspects.

AAPL Performance: Sailing through the storm

If you have been closely analyzing the Apple Inc. stocks, you wouldn’t doubt that the company noticed some severe ups and downs. In case you missed it, look at the chart below.

There were dramatic changes throughout the year. But to make things easier, let’s focus on the key dates;

January 2, 2020 :- NASDAQ recorded the AAPL open at $74.06, which if we compare with 2/1/2019 ($39.48), we can notice almost 100% hike in a year. And why not!! The brand attained some excellent benchmarks preceding year through its iPhone, iPad, and Mac sales.

February 19, 2020:- The stock showed appreciable growth by closing for the day at $80.90. By this time, things weren’t remarkable, but the team did have huge expectations after the launch of iOS 14 and its product line-up. But things didn’t go well.

March 23, 2020:- By this time, the pandemic’s impact could be noticed worldwide. This was why just ten days before this, Apple shared a press release announcing that the WWDC, 2020 will be digital. While the team was busy preparing for their first-ever digital event, AAPL noticed closing stock value steeping as low as $56.09. With this, Apple reached almost the same state as it was around October 3, 2018. Yes!! Almost a year and a half back.

July 28, 2020:- From June 22 to 26, Apple dedicated its time to WWDC’s digital event and announced remarkable upgrades to its iOS. Things not only recovered after a month but also exceeded the year-beginning mark by almost $20. The brand noticed the day-closing at $93.25.

September 1, 2020:- The event and its announcements worked like a magic wand for the tech giant. The brand started reaping fruits of its patience during the pandemic. While the brand became the first US company to touch $ 2 trillion in August mid, it also recorded the closing stock price of $134.18 on September 1.

September 18, 2020:- The team was all pumped-up and expecting a boost. This was due to two reasons; first, the milestone it attained in the month beginning, and second, they recently (September 15) took the curtains off their Time Flies event. However, no one expected a sudden fall to as low as $106.84. A drop of almost $28 in 17 days.

This wasn’t an overnight fall. The first deep drop was noticed on September 3 when the stock prices touched $120.88, and the second followed soon after its ‘Time Flies’ event.

The trend followed throughout upcoming events, and a fall and rise could be consistently noticed. However, the brand didn’t fall further and managed to reach the current $126.56 (as of December 21).

Despite this, if you’ll have a look at the quarterly reports (1st,2nd, 3rd, and 4th), you can notice that the Cupertino-based tech giant has shown growth in comparison to the last year. Considering all this, I believe, by January 2021, it’ll manage to recover completely and will gain back or even cross the 2020 highest mark.

Products and Services Launched in 2020

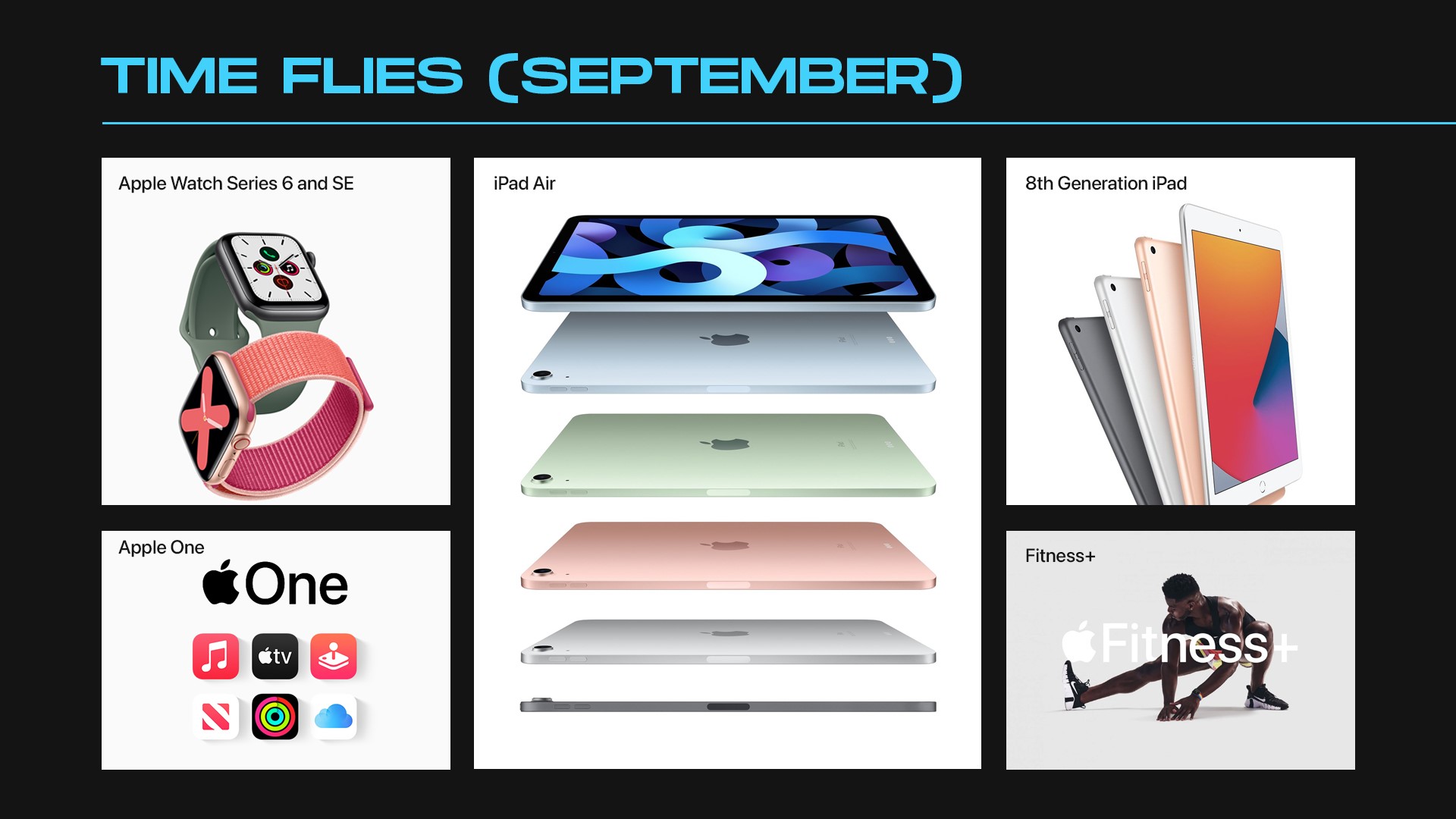

Time Flies (September)

• Apple Watch Series 6 and SE

• Fitness+

• Apple One

• 8th Generation iPad

• iPad Air

Hi, Speed (October)

• HomePod Mini

• iPhone 12 line-up

• MagSafe Charger and Accessories

One More Thing (November)

• 13” MacBook Air with M1 Chip

• 13” MacBook Pro with M1 Chip

• Mac Mini with M1 Chip

December 2020 Store Release

• AirPods Max

The Redefined Modus Operandi

The question is, how did it manage to do all of this? Besides the remarkable sales figures of iPhone 11 and SE, various reasons together played an invincible role.

After learning thoroughly and following each step of the brand, I could bifurcate the redefined Operandi into two parts. Let’s get acquainted with them individually.

Plans for India

2020 was a significant year in terms of the relationship between Apple and India. Apple launched an online store, explicitly for India.

Let’s not forget about the ongoing Wistron Corp’s Southern India establishment. Although Apple didn’t spend time addressing the recent brawl, it plans to keep its supplier under probation until further notice.

In addition, there’s no report of its impact on Pegatron’s plans, under which it is investing around $1 Billion over India’s establishment. It is expected that the ongoing construction work at Mahindra World City near Chennai is expected to finish in a month or two.

The growing interest in the second-largest smartphone market globally is a sign of Apple’s future growth plans.

Apple’s plan for India witnessed a sharp increase after the tech giant decided to lessen its dependence on China post-pandemic. There’s a lot to expect shortly. Let’s hope to have some positive output by the second quarter report of 2021.

Expanding Market Segment

With its recent product launches, it can be noticed that Apple is aiming to expand its market share by developing something for everyone. It is unveiling a pocket-friendly as well as a luxury variant simultaneously.

Traces of this can be found in every product line-up; Affordable Mac-Mini and MacBook Pro, iPhone 12 Mini and iPhone 12 Pro Max, AirPods & AirPods Max, and Apple Watch Series 6 & SE.

It looks like this is going positive for the company. At the events, Tim shared that 50% of their customers are new buyers. What do you have to say about it?