Home prices are skyrocketing. However, so are missed mortgage and rent payments. For answers, I interviewed Mike Fratantoni, the chief economist of the Mortgage Bankers Association.

Chief Economist, Senior Vice President, Research and Industry Technology

Mortgage Bankers Association

Are you sick of renting? Have you watched real estate prices soar, and rue the day that you didn’t buy? Are you feeling equity-rich, but itching for a move? Are you worried about losing your home or job? Are you underwater on your mortgage? What’s the best plan for real estate in the pandemic and beyond?

Signs of Distress

In September 2020, 8.5% of renters, 7.1% of homeowners and 40% of student debt borrowers missed a payment (source: Mortgage Bankers Association). Meanwhile, home prices soared to an all-time high of $311,800, up 14.8% year over year (source: National Association of Realtors). How is it that there are so many distressed borrowers (2.82 million rental households, 3.37 million homeowners and 26 million student debt borrowers), and why isn’t that impacting home prices? Should you buy a home now, while mortgage rates are at an all-time low, or hold off until home prices are more affordable? Mike Fratantoni shares his wisdom, research and crystal ball projections for home prices and mortgage interest rates in 2021 and beyond.

Natalie Pace: How is it that unemployment is high, concerns about the ongoing pandemic are heightened, missed mortgage and rent payments are elevated, and yet home prices are soaring?

Mike Fratantoni: Mortgage rates are very low. The Millennial cohort is getting to peak homebuyer age. There are enough people who have jobs and have not been directly impacted by the shutdown. They are able to maintain their income, and have enough confidence that they are able to maintain that going forward. We are very optimistic about the purchase market in the next couple of years. We’re more worried that there is just not enough inventory on the market. You’re talking only 3 or 4 months of supply at the current pace. There are not enough units on the market.

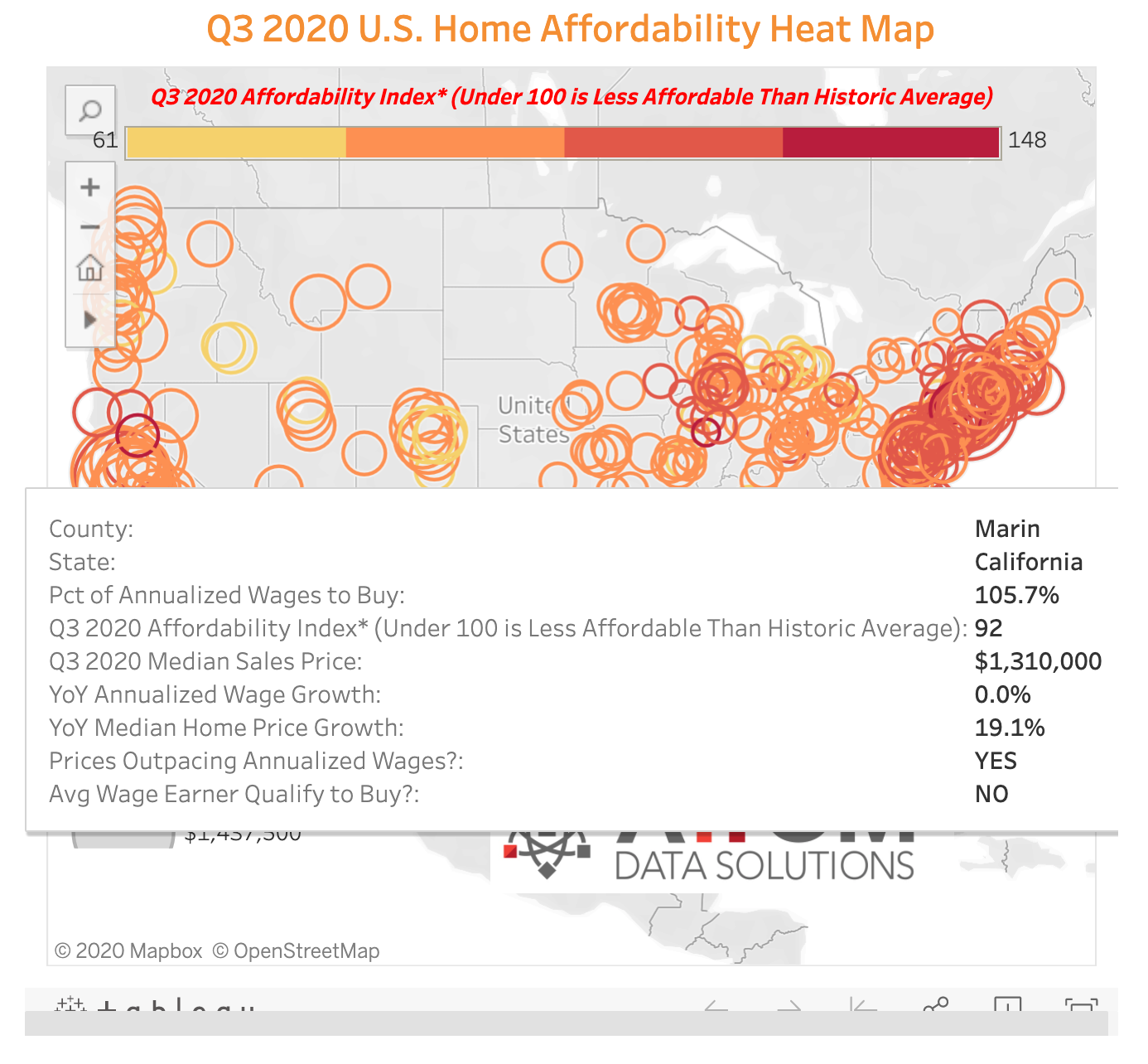

NP: According to AttomData, median-priced homes are unaffordable to the average wage earner in 61% of U.S. counties. Where are prices headed for the rest of the year? Will the pandemic and unaffordability pull prices down?

MF: In a situation where we don’t have enough housing stock in the country, prices are going to stay high. Home prices are likely going to keep going up. Even with high unemployment, the mismatch between still strong demand and constrained supply is going to keep home prices increasing even next year, as we exit from this pandemic.

NP: There are still 3.5 million homes that are severely underwater on their mortgage. Do you think these homes, and other shadow inventory, might be a factor in subduing home prices going forward?

MF: I don’t see that as a large number of households at this point, given that home prices have grown in the last decade and will continue to grow into next year. That is not the same issue as it was in the Great Recession.

NP: Unaffordability has become an industry buzz word, yet the situation is only becoming more dire. What can be done to right-size prices for would-be homeowners?

MF: We see it as an issue of constrained supply. We need more buildings in cities, suburbs and rural areas. We need it everywhere.

NP: Some cities, like Manhattan and San Francisco where the average wage earner is completely priced out of ownership, have seen a dramatic increase in listings and a lowering of prices. According to Zillow, home prices sank 4.2% and 4.9% in 2020 in Manhattan and San Francisco, respectively. Inventory in San Francisco has jumped 96%.

MF: You naturally would see Millennials leave the cities and move to the suburbs as they are having children and looking for schools. That was happening any way. With the pandemic and concerns about urban conditions, is this just another reason on the list to move out of the city? Will we see that happening in more and more places? In most parts of the country, it’s tough to tell if this is an additional factor or just the continuation of a new trend.

NP: Your data shows that credit is tightening. Will that impact buyers?

MF: We’ve seen a jump in delinquencies of FHA loans. That has led many lenders to become more cautious with first-time buyers who might get an FHA loan. So, they’ve put in an overlay requiring a higher minimum credit score. At the other end of the market, for jumbo borrowers, we’ve seen tightening. Banks have so many competing demands that they have tightened up any type of loan that they were going to hold. That includes jumbo loans. However, credit being tight is not impacting overall purchase demand.

NP: Where are mortgage interest rates headed?

MF: Mortgage rates tend to track the 10-year Treasury rate. Because of the large U.S. deficits and the incredible amount of debt the Treasury is going to have to auction, there will be some upward pressure on 10-year Treasury rates and mortgage rates. Today, we’re closer to 3.0% for a 30-year fixed mortgage rate. We think that will be closer to 3½% next year. It’s not an enormous increase. Prior to this year, that would have been a record low. I would not be surprised if in two or three years, we’re back above 4.0% again. That’s not historically high, but it is higher than we are today.

NP: Back to the distressed homeowners and renters who are behind on their payments. What should be done to help them?

MF: It’s important either through stimulus payments, or enhanced unemployment insurance, or through direct rental assistance, to help them pay their rent, as opposed to preventing them from being evicted after they don’t pay their rent. An eviction moratorium transfers the problem from a rental household problem to a landlord problem, and kicks the can down the road. The eviction and foreclosure moratoria make sense from a public health standpoint. But it is not correct to think that they are going to solve or mask a problem. It is just delaying and transferring that problem onto another actor.

If you’d like to hear my full interview with Mike Fratantoni, including his wisdom on the commercial real estate market, go to YouTube.com/NataliePace.