A yearly extravagance assessment of Rs. 4000 is collected on structures which are built on or after 1.4. 1997 having a plinth region of 278.7 sqm or more, notwithstanding the one-time charge.

Is it true that you are an inhabitant of Kerala? Indeed, at that point you should pay your Property Tax Kerala on the off chance that you are the proprietor of a property here. There are a couple of central issues that are basic to be gotten out first, before you discover how the online duty installment can be made, with no issue. In any case, how about we start with the rudiments first.

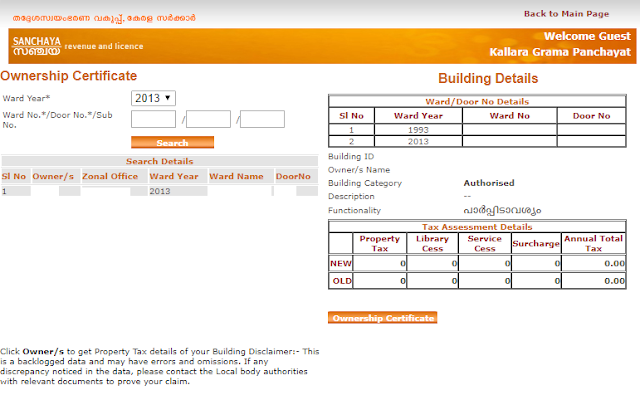

Paying Property Tax Kerala online in Kerala

As per a nation shrewd command, all city companies of India need to acknowledge online installment of Property Tax Kerala, through their authority site. Thus, on the off chance that you need to complete your installment on the web, at that point you should visit the authority page of the city company. There are different neighborhood self-governments in the state, who will gather the expenses for you and you can locate your necessary one at http://lsgkerala.gov.in/en/propertytax

Variables deciding the Property Tax Kerala esteem

What are the different components on which your Property Tax Kerala esteem depends? If there should be an occurrence of Kerala, the kind of land, the sort of building, the absolute territory covered by the property, the area, the rentable estimation of the property, if qualifies as an extravagance condo, and so forth every one of these elements decide the last worth. Your Property Tax Kerala is additionally relevant in the event that you own a land parcel. All things considered, the charges for the Property Tax Kerala worth will fluctuate.