Are you anxious about money? Have you recently lost some or all of your income? Are you worried about protecting your wealth and retirement? Having a plan, and knowing what is really happening from a Wall Street insider, can replace fear with wisdom, which is the stepping stone out of stress and into a data-driven, time-proven action plan.

Meet Howard Silverblatt, the senior index analyst of S&P Dow Jones Indices, who is responsible for the statistical analysis and commentary of the S&P 500® (and other indices). Howard has been working at Standard and Poor’s since 1977. So, if you’re wondering where the markets are headed, how you can protect your retirement, or ways you can help out a struggling family member or recent college grad, Howard and I cover all of this in the interview below.

Natalie Pace: You may not have seen it all. However, you have seen Black Monday 1987, the Dot Com Recession and the Great Recession. So, polish up your crystal ball, and tell us what’s happening. How does the pandemic compare to past weakness on Wall Street?

Howard Silverblatt: The main difference is the speed in which it turned. Corona has totally changed our lives. It has changed business models, our ability to work and introduced liquidity issues. Many companies are deciding that people don’t have to work in the office. There’s nothing like the speed of the mindset change in modern times.

NP: So, it’s understandable that people are stressed, anxious and confused. Our lives have been upended. The pandemic has hit Main Street very, very hard, with the high unemployment, at over 20%, quarantine, and being with family members 24/7. It seems too good to be true that Wall Street has such a strong rally going. What is going on behind the scenes that we should know about?

HS: This quarter, the as-reported GAAP earnings per share is coming in at $12.50 per share, as compared to $35.53/share in the last quarter. So, we are down two-thirds. Imagine your paycheck, that you are still getting paid but you are taking a two-thirds cut on it. Corporate earnings have taken a significant cut.

NP: It seems disconnected that earnings have tanked, but stock prices are soaring. Is Wall Street overpriced?

HS: As far as P/E goes, let me get a tissue because I think I’m going to have a nosebleed. We’re so high now. Historically, we’d be at 17 or 18 on the high side. Now, we’re in the 22 or 23 range. Again, earnings are down a lot now, and are expected to be pretty bad next quarter as well. 2020 has basically been written off. There is a hope that we’ll hit the bottom in 2Q and then turn up in the third and fourth quarters. So, we’re selling on forward outlooks for 2021. It’s a very high multiple that we’re putting on there. If we do not see that improvement with the 3Q numbers, we’re going to have to reprice. That repricing could be costly. We would expect more volatility, such as the way we had in February and March.

NP: During the Great Recession and the Dot Com Recession before that, when markets dropped by more than half and took so long to recover, people lost their homes. Some weren’t able to retire. And yet if we sell stocks and get more liquid, and the markets come roaring back like they did in April, we feel like an idiot.

HS: Know your own risk tolerance and liquidity. Everyone wants to make a buck. The bottom line is, “If you can’t afford to lose it, don’t bet it.”

NP: Market timing doesn’t work. Buy & Hope has been like riding a rollercoaster this entire 21st Century. How can the average person gauge what they should be doing?

HS: Diversification is important. Technology is up, but you have 37% losses in energy. It could be an index, or a basket. There are a lot of instruments out there. With dividend stocks, don’t get the highest yielding one. Get one that is going to keep paying you. Find someone whom you trust to help you. It’s not that easy to do. When you see all of the professionals having trouble doing it right, it tells you that it is not that easy.

NP: Are there certain industries that are more in favor?

HS: Technology is sitting at the forefront. If you go to the manufacturing part of IT, like semiconductors, they have to worry about opening up the plant. They have to ship products, unload the boat and get it to the shops.

E-commerce is more in demand, while many retail stores are completely closed.

Utilities have money coming through. I don’t even want to see my electric bill this month. I’ve got four monitors running in my work-from-home office.

NP: What will separate the winners from the losers?

HS: Liquidity is key now. Money will get corporations through the situation. Also, is my store open? If my store is closed, I’m not doing very well on sales. I still have rent. I still have costs and inventory. I have another season coming up.

NP: So, retail, airlines, sports, hotels and bars – these are all activities that are either closed or operating at a fraction of the capacity they were at in early February. We’re also working from home and driving a whole lot less.

HS: Retail is a very risky area. Retail has been hit by a lack of sales. If they own their own real estate, that has now deteriorated in terms of value. Malls are in trouble, with so many stores closed up. Energy is another risky area. We have a supply problem, too much, with much lower demand. Oil has gotten hit by both sides.

The airlines have had an enormous hit. It’s going to take years to come back. They may not get those business travelers back. Financials are doing terrible.

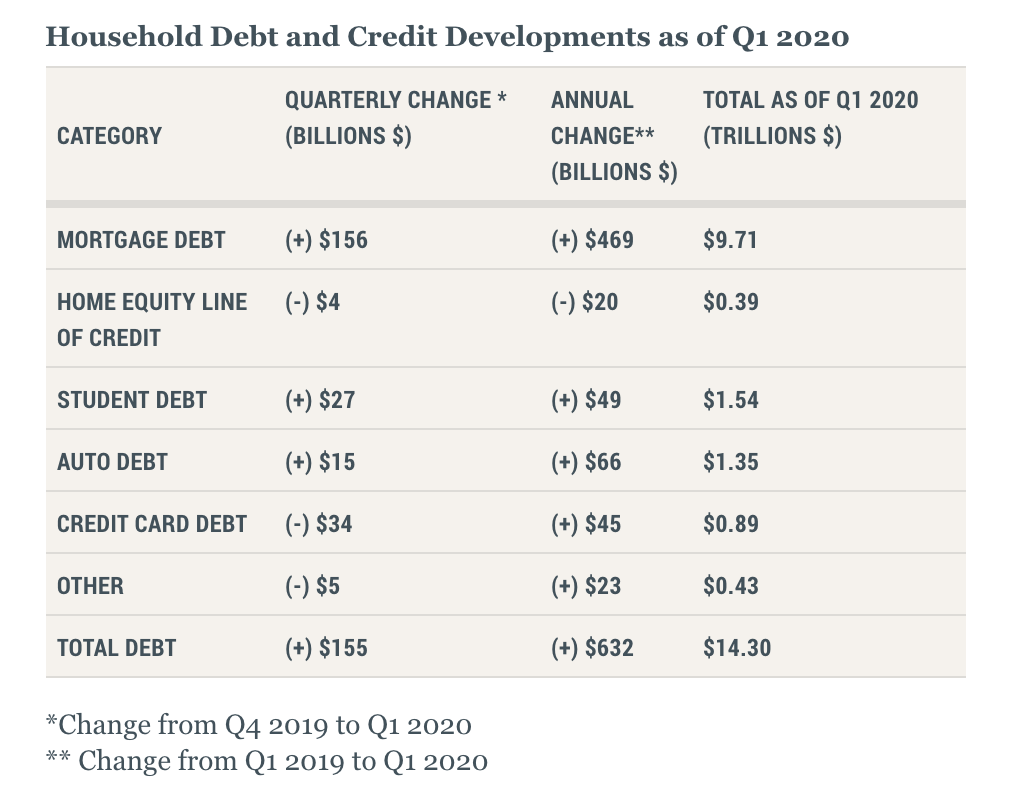

NP: Some financials are more vulnerable than others, right? I would assume that some smaller banks may have to restructure, as will mortgage providers and credit card companies. Insurance companies had to be bailed out in the last recession. The large banks are having an earnings issue. However, so far, they are saying that liquidity isn’t a problem.

HS: I’ve never seen a financial company that ever said they did not have good liquidity, right up to the point where the Fed forced a merger down their throat. Credit card and car loan defaults are predicted to increase. How do I make money on a loan, and even cover my costs, when rates are so low?

NP: What about the younger generation? Should they be investing?

HS: When my kids first started working, I opened up a Roth IRA for them. Unlike me, who has somewhat of a pension, they are responsible for their own retirement and their own healthcare. Investing when you are 22 is so much easier than when you are 35 with a mortgage, or 45 with kids in college or 55 and looking to retire. Time is on your side for compounding.

NP: What about someone who recently graduated from college or lost their job? Do you have any tips on how to help Millennials and Gen Z who are facing all of the challenges of Gen X and Boomers, with student loan debt lopped in on top?

HS: My son is with me now. He’s 23. He just graduated. He went on vacation. When he came back, he looked for a place. Now he’s back home. In my daughter’s building, there are only about 40 tenants left out of about 400. They all went back to mom and dad. People are thinking, “If I can work from anywhere, why am I paying 40% of my income to rent?”

NP: Thank you,Howard, for sharing your wisdom and experience with such clarity and transparency. We appreciate it!

Whether you are thinking about Intergenerational Housing as a solution to help a friend or family member weather the economic storms, or wondering what you own in your retirement accounts, to make sure that your exposure to stocks and bonds is in your best interest, wisdom and time-proven solutions are the cure to ease your anxiety, stress and concerns. You can watch my full video interview with Howard at https://www.YouTube.com/NataliePace2. Learn more about easy, time-proven budgeting and investing strategies at https://www.NataliePace.com.