Are you always short on cash? Do you think you spend a lot? Well, even if you are not a shopaholic, you find yourself broke most of the time, that’s a clear sign you need to plan your finances. Some of the financial habits leave people with empty pockets.

They despite carrying the guilt of not planning their finances cannot stop themselves from spending. Over-spending or a carefree attitude towards managing your earnings may bring temporary happiness, but when the reality hits, you find yourself stuck under the burden of unpaid bills.

As per the statistics, around 73% of Americans have not more than $1000 as their savings in the account. You can switch gears of your financial life by simply avoid some bad money habits. So, here is a blog to help you identify your habits with effective alternatives. Read on!

Habit #1- You Don’t Realize How Much You Are Spending

By the time your account reaches zero, you do not pay attention to your daily spending. Instead of waiting to get broke and then calculating the budget, it’s better to make a monthly plan. Prioritize your needs and fulfill them first. Do not be hard on yourself; you can be rational and practical while planning your expenses. Keep a separate amount for fun, shopping and entertainment. You can use Personal Capital to track the net worth and the amount you spend. Pay the bills, buy the essentials first, and then think about spending on something else.

Habit #2- Spending More Than You Earn

You will forever stay broke if your spending is more than your earnings. Limit your finances, know how much you can spend. It’s hard to save money but if you take mature and practical moves you can save a lot of bucks without getting bothered much. Make a rule: save at least 10% to 15% of your total earnings every month. Within a year, you will find yourself having a lot of savings.

Habit #3- Spending On Mobile Apps

How many subscriptions on have? Do you use all of those apps regularly or frequently in a week? You may find the $1.99 in-app purchases inexpensive or the exciting subscriptions a must to have. But this spending can create a snowball effect. One day, you will realize how much money you have spent on these mere apps, which you least bothered using. So, be more selective and do not fall for every marketing trap. Marketers show things in a captivating manner designing the strategy to attract the users. You need to find such red flags and keep yourself away as much as possible.

Habit #4- Paying Bank Fees

Do you know you can easily avoid most of the bank fees? Are you worried about checking deductions every now and then by your bank? Well, you can seek help from any financial institute that can tell you about the ways of avoiding certain charges. There is one thing, if you deposit a minimum of $500 in your bank account and leave it there you can avoid certain charges. Similarly, you need to crack these ways that can help save some penny. In this way, you will be rest assured to leave your earnings without the fear of getting deducted.

Habit #5- Using Your Credit Cards Wrong

How do you feel when you find an empty bank account and suddenly realize that you own a credit card? It’s surely a moment of ecstasy but if you ponder closely your bank account is empty because you are using the credit card. You do not have the money but still, you are making purchases on your future earnings. In this way, despite getting paid at the end of the month you will still be in debt. This cycle goes on and on. Every month you pay for your previous month’s spending and create a financial gap in your current status. So, get yourself out of this loop.

Habit #6- Making Late Payments

Similarly, avoiding paying your bills does not bring you any good. Prioritize your bills. As soon as you get the payment, pay off all your bills including that of your credit card. Late fees are a complete waste of money. Your bill stays the same and an additional amount gets added just by delaying the payment. So, if you spend then do keep in mind the due dates of your bills.

Habit #7- You Only Rely On One Income Stream

Are you relying on just one income stream? Warren Buffet once quoted, “Never depend on a single income. Make investment to create a second source.” He was one of the richest men and he guided the people to have multiple sources of earnings. It’s not wrong to have a lot of wishes but to plan big while having only a handful of money is going to cause you a lot.

You will end up in debt or sacrificing your dreams. Therefore, always have more than one source of income to double your earnings. For instance, if you are doing a 9 to 5 corporate job, you have your weekends to take on freelance projects. Build your private network and make a mark in the market. So, if for any reason your company fails to pay you, your expenses will not get affected.

Habit #8- Ignoring Insurance

You may think you do not need an insurance plan right now but life is unpredictable. Just one accident can leave you completely broke. You may experience any kind of setback in life; you need to have the money saved yearly to use it at the time of dire need. Every month a minimal amount is deducted from your account, which you not be bothered by, but with time, you can have a lot of bucks piled up in your account. So, think about it and consult an expert who can guide you about easy insurance plans.

Habit #9- Investing On Unreliable Plans

Are you a person who is always chasing one business plan or the other? Do you look for shortcuts to become a millionaire? Well, it’s good to keep hunting for long-term profitable means but it’s imperative to stay sane and take smart moves. If you have your savings and are planning to invest them in something, evaluate the business model twice.

Consult professionals or seek help from experienced entrepreneurs before making a move. You must be sure about the business which you are thinking of pursuing. Do not get over-enthusiastic and avoid critically analyzing the situation. Because if you lose, nobody can pay you back the amount you wasted.

Habit #10- Keeping A Consumer Mentality

A consumer mentality is about showing interest in short-term goals by buying materialist things. Instead of saving your cash to work on long-term achievements you rather choose to get the pretty ball you saw in the shop earlier. That ball is of no use to you yet you get fancied by its pompous discount and decide to buy it. Similarly, you spend your money on buying clothes, getting a dog, or hosting a part instead of looking for a business plan from which you can generate a revenue stream. This is what a consumer mentality is, you think small and get engaged to the discounts and other marketing tactics the retailers use.

You need to keep yourself away from such habits and instead spend cautiously.

Habit #11- Keeping Up With Social Standards

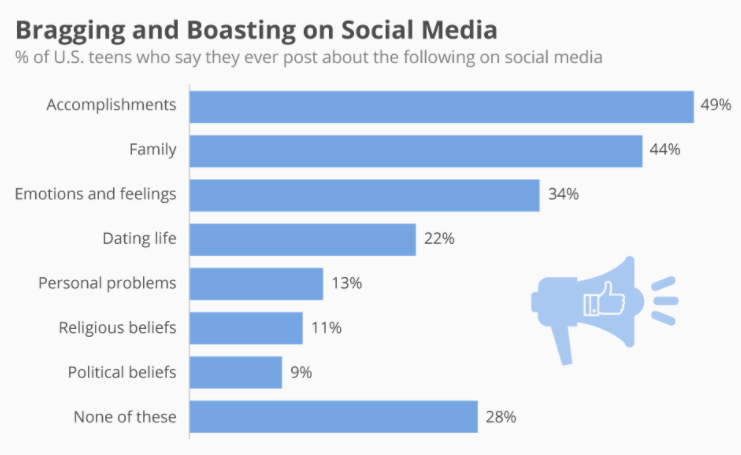

Do you want to brag about how cool your life is on social media? Do you have an obsession with posting expensive pictures just to get more likes and comments? As per the PEW Research Center, teenagers spend most of their time on social media platforms but what’s more concerning is their activities. They are more involved in bragging and boasting about their accomplishments with their followers. See the stats below:

Source: Statista

To maintain their personality and outlook of life, people spend on irrelevant or not-so-important things. They strive hard to show the world how happy their life is when in reality they are the most depressed and always broke. So, try not to spend just to please others. You are working too hard to earn that money and if still, you are in debt it means something is not going the right way. You have to take a step back and plan things more properly. Everything will stay under control and you will stay at peace.

Wrap Up

If you want expert help to help you save your money and put a tap on your spending you can download some of the great money management apps. On both IOS and Android, several apps are there that are helpful and full of features to manage your finances. Apps like Spendee, Expensify, Budget: Daily Finance, Pocket Expense and Toshi Finance, are some of the renowned names. All you need to do is integrate your bank accounts and cards and let the app calculate and predict your savings.